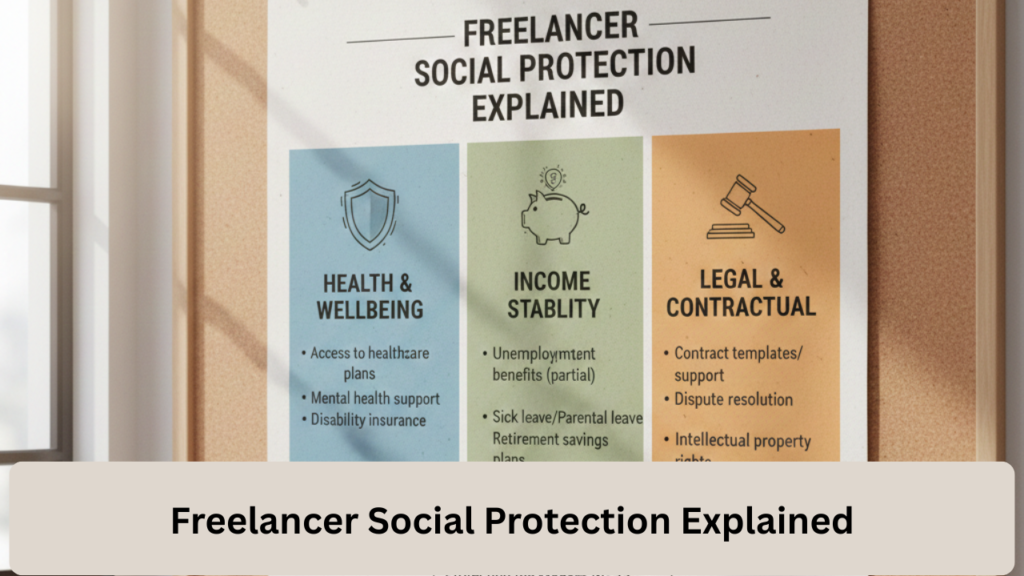

Freelancer Social Protection Explained. Freelancing is one of the most common types of employment in the world. Both in the manner of the online platforms and teleworking and the trend of making up more adaptable living, millions have opted to operate independently rather than have an ordinary job. Nevertheless, despite the jolting development, a range of obstacles linked to freelancing, specifically with regard to social protection, namely, the systems that should secure it.

The people against financial risks, illness shock, and revenue uncertainty are also present. Freelancers not always entitled to such benefits as health insurance, pensions, paid time off, and unemployment protection comparison with salaried workers. The essay is a clear and elaborated description of what freelancer social coverage is, why it is relevant and how freelancers can work their way through and improve their coverage today. The freelance economy is gaining more ground, and it is becoming.

Very apparent that there is a greater responsibility that comes with it. Although the traditional employees depend on their employers to make the contributions and access safety nets, freelancers are left to handle these important areas of their working lives independently. This is due to the fact that even the tiniest of disruptions, say a sudden illness, loss of a key client or a market shift, will affect their financial stability significantly due to the absence of institutional support.

Knowing The Social Protection of Freelancers.

Social protection, in general, can viewed as the efforts of the government and non-governmental organizations to help people to cope with any risk that can devastating to their well-being or their economic condition. Governments, like health care, retirement pensions, and disability assistance, can offer social insurance depending on the necessary payroll contributions. The employers tend to control the administrative part, paying a part of the cost.

Freelancers, on the other hand, lack employers. They also work as solitary employees and this means that they must undertake vigorous efforts to administer and provide their own safeguards. This leaves gaps that may become very poor in case of crises, illness, or poor economic climate. Due to the fact that freelancers left to themselves to find their way through difficult systems, the lack of automatic enrollment or employer benefits usually leaves a big coverage gap.

A large number of the independent workers lack health insurance, stable retirement, and income protection, which puts them at a higher risk in instances of unforeseen problems. Lifestyle changes in the form of irregular incomes, late payments by clients and work cycles where work is based on projects also make them vulnerable to committing to regular and constant payments. Consequently, freelancers can delay or even not pay at all for social protection, becoming more vulnerable with time.

The freelancer social protection may contain:

- Insurance for health

- Work-injury coverage

- Family and parental benefits.

- Unemployment assistance or income.

- Retirement and old-age pensions.

- Emergency funds and savings

- Private insurance plans

Although other nations have started building inclusive mechanisms to accommodate freelancers, in most cases, they operate in the traditional labor systems constraining freestanding employees.

The Reason Social Protection is important to Freelancers.

Income Uncertainty

Freelancers will have a low stable income, intermittent payments, and wages based on projects. It can destroyed in an extremely graphic fashion by a health emergency or something that would render them unable to work at all.

None of the Benefits of the Employer.

Full-time workers are usually offered insurance, paid leave, and a pension. These need to obtained by freelancers independently, usually at increased prices.

Economic Vulnerability

Freelancers lose their income support or unemployment benefits, making them more vulnerable at times of market decline or loss of clients.

Financial Stability in the Long-run.

The self-employed usually do not save towards retirement because they are usually able to earn more or less money and thus they are more likely to be poorer in old age.

Professional Credibility

Freelancers can look more trustworthy and stable to their clients by having access to any social system of safety that has registered, e.g., health insurance or pension schemes.

The main elements of Freelancer Social Protection Health Insurance

Health insurance is the greatest and most urgent requirement of many freelancers. Nations with universal healthcare include independent workers in the programs of national programs or other policy, but in other nations, freelancers have to participate in the national programs or other policies voluntarily.

Freelancers should:

- Compare national vs. private health coverage

- Take into account premium prices based on fluctuation of incomes.

- See whether the plan provides outpatient care, hospitalization, and chronic illnesses.

- Research the possibility of cooperative or community health insurance groups Groups with lower prices.

Without health insurance, a person may end up spending big money in case unexpected medical complications arise.

The Security and Stability of being a Freelancer.

There is freedom and flexibility among freelancers; however, there financial and social risks involved that should not be ignored. Social protection is not only a lifeline but a pillar to the sustainable freelance jobs. Freelancers are also guaranteed by means of health insurance, income security, retirement plans, and even family benefits to work on their business without fearing any unexpected challenges.

Having an understanding of diverse options, pre-planned strategies, and seeking the support of cooperatives, platforms, and governmental programs, freelancers will be able to build a stable and strong professional life. Social protection adoption is an investment in personal well-being, economic stability, and occupational sustainability, and thus, it should confirmed that freelancing remains a viable and rewarding career opportunity in the modern labor market.